Tourism, housing sectors on recovery path

The tourism and housing industries in Cambodia are showing signs of recovery this year, according to the ASEAN+3 Regional Economic Outlook.

Answering questions from Khmer Times at a virtual press briefing yesterday, AMRO Chief Economist Hoe Ee Khor said the country’s garment industry is likely to face a setback due to the slowdown in its major export markets.

“Cambodia is a major garment exporter and a lot of such exports go to the US and Europe. However, due to the slowdown in those areas, Cambodia’s garment industry will take a hit. It will be weaker than the previous year,” he said.

However, the Kingdom is expected to offset such setbacks due to the recovery in the tourism and housing industries, Khor pointed out.

“Because of the recovery in China, the tourism sector in Cambodia is getting a big boost. We expect tourism to recover in Cambodia this year and that would help offset the setback in the garment industry,” he said, adding: “We are hopeful about the housing industry, which was down because of the Covid-19 pandemic for several years, is coming back again.”

He said the ongoing resumption of tourism — especially with the return of Chinese tourists — will provide a much-needed boost to growth in ASEAN.

“With recession risks still haunting the United States and Europe, China’s economic reopening cannot come at a better time for the region,” Khor observed.

The economist also pointed out the revival in the fortunes of several other sectors in the country.

“With other manufacturing sectors, other than garments starting to pick up, there would be more investments now. The bicycles and shoe industries are expected to do well this year. Overall we are quite optimistic about growth in Cambodia,” he pointed out.

Earlier, the ASEAN+3 Macroeconomic Research Office (AMRO), in its January update, said: “Travel and tourism growth in the region has accelerated, thanks to the removal of travel restrictions and the resumption of international flights since the second quarter of last year. By fourth quarter, most economies — including Brunei, Cambodia, Korea, Malaysia, Thailand, and Vietnam — had removed all pandemic-related border measures.”

It said the expected large influx of Chinese tourists amid the ongoing surge of Covid-19 infections in China prompted the reintroduction of Covid-19 testing and temperature screening in some regional economies.

While observing that the restrictions were relatively mild, it reiterated that tourism activity in the region is on track to increase further.

Cambodia’s inflation, projected at 5.3 percent last year, is expected to come down to 3 percent in 2023.

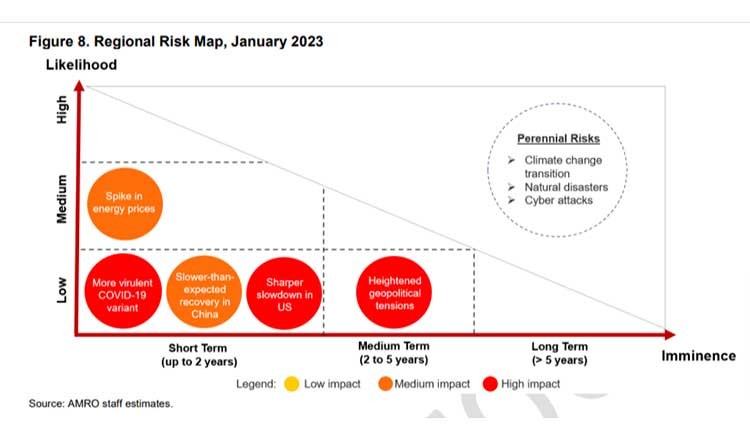

The agency also revised downwards its short-term growth forecast for the ASEAN+3 region.

While pointing out that the deteriorating global economic conditions are weighing on the region’s outlook, it said China’s reopening last December should provide some counterbalance. Its January Update projected 3.3 percent growth, down from 3.7 percent growth forecast in October for ASEAN+3 region in 2022.

It said the lower projection was mainly due to continuing weakness in Plus-3 economies, especially China where growth has turned out to be much weaker.

However, growth in the ASEAN region, buoyed by strong domestic demand, is revised upwards to 5.6 percent.

“This year, growth in the ASEAN+3 region is projected to strengthen to 4.3 percent, as China’s economy is expected to rebound strongly reflecting the removal of containment measures and reopening of its economy,” the update said.

It said inflation is anticipated to come down to 4.5 percent in 2023 from the projected 6.3 percent spike last year.

“The weakening global environment has taken the wind out of the sails of the region’s external trade momentum. The drag on economic activity from aggressive monetary policy tightening in the United States and euro area will be felt more fully this year, translating to softer export orders for the ASEAN+3,” the agency noted.

“With recession risks still haunting the United States and Europe, China’s economic reopening cannot come at a better time for the region,” Khor said, adding: “China’s stronger economy will provide support for regional activity while the border reopening will boost intraregional tourism.”

It said the ASEAN+3 region grew strongly in the third quarter of last year.

“Domestic demand remained resilient and offset the drag on growth from net exports. ASEAN, Japan, and Korea led the expansion as further relaxation of containment measures alongside high vaccination rates enabled more economic activities, such as retail trade and construction, to resume,” the update observed.

Regarding China, it said the domestic economy was supported by economic stabilization policies.

The update also noted that inflation was moderating across ASEAN+3, tempered by sustained policy tightening by central banks and easing global supply chain bottlenecks. Oil prices have reverted to almost pre-pandemic levels reflecting weaker global demand.

It said prices of key agricultural commodities — although remaining relatively high due to the prolonged war in Ukraine — have fallen from their peaks in 2022.